Sure, it has been a very tough begin to 2024, particularly for studios in search of funding. Ending out 2023, it felt like enterprise capital funds closed the taps of years’ previous, and publishers hit the pause button. Fortunately, the vibe at GDC was barely extra optimistic, with new offers being introduced by each publishers and VC funds.

Whereas the checkbooks are again out, there’s a sneaky shift that is been occurring over the previous few years: The burden of proof that an viewers exists for a sport is falling an increasing number of on the shoulders of the developer.

This want for proof, or traction, is a complete layer builders want to fret about past simply constructing an important prototype and placing a robust group collectively. This was very a lot echoed in the investor replace article posted on this website previous to GDC.

The subsequent logical query is, ‘What variety of proof do I want to provide?’ Sadly, the reply is, ‘It relies upon.’ A number of vectors to take a look at are the diploma of social proof, the degree of group engagement, and your funnel metrics.

Social Proof: That is all the stuff that reveals others assume what you might be doing is fascinating and price listening to. That is typically manifested through social media likes and follows, or trailer views, and even your quantity of wishlists. E-newsletter subscriptions depend, too. The extra the higher, of course. This may additionally cowl stuff like juried pageant choices, profitable pitch competitions, or press preview protection (eg, “the most fun RPGs coming subsequent yr”-style articles).

Neighborhood Engagement: Going one degree deeper than simply liking a tweet, to what diploma are you constructing an engaged group round your sport?

This can be manifested through lively Discord members, playtesters giving suggestions, and streamers participating with early builds of the sport. For instance, the average playtime of your demo or beta construct is a essential knowledge level to display that your core gameplay is participating and sticky.

Funnel Metrics: Now we’re getting all the way down to the nitty gritty of your person funnel, the course of by which you make somebody conscious of your sport, encourage them to guage the sport, then wishlist/again/obtain/purchase the sport, and turn into a fan.

Funnel metrics have a look at the price and effectivity of bringing somebody down the funnel. Particular measures to take a look at may very well be the price/effort to get a brand new wishlist, or the price/effort to get a brand new Kickstarter backer, or the price/effort to generate a brand new obtain of your cell softlaunch construct.

Every of these vectors for proof and traction creation is a deep subject that deserves a lot additional exploration, however this begins to offer you a way of the issues that the individuals with cash prefer to see to de-risk their selection of who to offer that cash to.

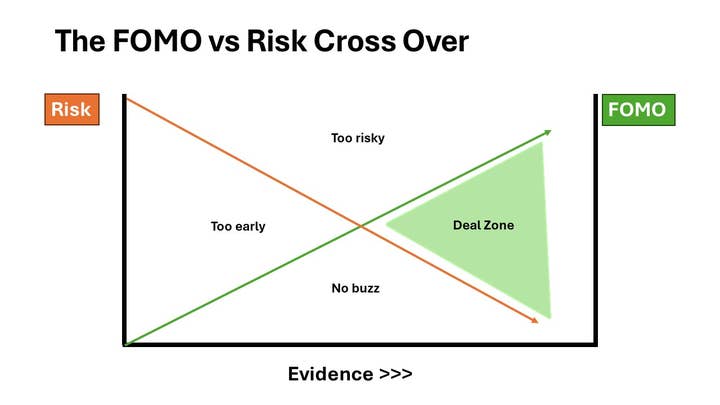

Actually, conceptually, there’s a candy spot the place you’ve got generated sufficient proof to de-risk the mission (ie, validating the viewers) and in so doing, you might be creating buzz/FOMO round your alternative. After that crossover level is the magical “deal zone.” Too quickly, and you might be nonetheless seen as too early, too dangerous, or simply not having sufficient buzz but.

If you’re chasing enterprise funding, that is notably tough as you may have differing types of traders coming in at completely different phases of the firm.

Initially, it’s essential to remind builders that you need to solely be pursuing firm equity-level funding choices (ie, angels, VC funds, company/strategic funds) if you’re primarily multiplayer GaaS + free-to-play, doing one thing really bold that has the potential to scale exponentially right into a billion {dollars} of worth. All these doing cool PC/console single participant premium video games are finest to stay to sources of mission financing, like publishers, mission funds, Kickstarter, and so forth.

The primary investor is at all times you! At the very starting, you don’t have any proof, so solely you (and your co-founders) are keen to speculate the time and sources to get the ball rolling. As soon as you’ve got made some progress on the product, and the group, that is most likely sufficient to persuade your family and friends (and fools) to speculate into what you might be doing.

With these funds, you can also make additional progress on the group and the product, and begin to generate some of the traction that angels will need to see. As soon as angels make investments, you then proceed to construct proof in order to persuade the VCs to speculate.

That is a considerably oversimplified view of issues, however in brief, the cycle is about utilizing the present traders’ cash to generate the proof required to persuade the subsequent (often bigger) investor to speculate. It’s an arduous and incremental course of to fund your organization.

Pace-to-evidence have to be a enterprise crucial for all studios in search of exterior funding. Simply making progress on the sport construct is never sufficient to unlock funding in at the moment’s extremely aggressive funding surroundings. The extra traction you may have, the nearer you get into the deal-making zone.

If you’re approaching that zone, and are wanting to pitch your organization to VCs and angels, the Video games Capital Summit is a perfect alternative for you later in Might.

Hosted as a pre-event of the Nordic Recreation Convention, the Summit welcomes over 20 enterprise traders (eg, Makers Fund, Behold Ventures, Transcend Fund, Sisu Recreation Ventures, and so forth). Then we hand choose solely 12 firms to lock in the room and pitch/meet with these traders all afternoon on Might 21. The deadline to submit your utility is Friday, April 26.

Full particulars and submission kind through the official website.