When Embracer CEO Lars Wingefors declared an finish to the corporate’s nine-month restructuring program at the beginning of this month, you’ll have been forgiven for assuming that issues would lastly accept the troubled video games group.

That assumption was introduced into query on Monday when the corporate introduced it could be splitting into three separate entities: Asmodee Group, Espresso Stain & Pals, and Center-earth Enterprises & Pals (with new official names for the latter two to be revealed at a future date).

GamesIndustry.biz caught up with Wingefors mere hours after the announcement to speak via its implications, the way forward for the three corporations, and why – after the years-long aggressive M&A push that grew the Embracer empire – he has determined to now break it aside.

The CEO tells us the cut up allows Embracer to “higher finance our companies” and “decrease the price of capital.” And shareholders clearly approve, since Bloomberg studies the corporate’s inventory rose 18% after the information emerged.

“We want to create the optimum setting and circumstances for our companies to achieve success for us to make the best possible merchandise and to rent and retain the perfect folks,” he says. “And we have to have the optimum construction for these corporations to prosper inside. We’re a public firm and the present construction inside Embracer Group within the present setting is not optimum.

“To create profitable video games, and to retain and rent folks, the corporate must have that setting, and the setting for Embracer – and comparable corporations for that matter – has modified rather a lot. We had a variety of years, 2019 and 2020, the place the price of capital was actually low-cost and the willingness from buyers to speculate into development organically and inorganically by way of M&A was infinite. We additionally had a gaming market booming, particularly throughout COVID, and we had a way more stable geopolitical scenario, for instance, in Russia. All these elements have modified rather a lot.”

This, he says, is why Embracer introduced it was present process a ‘particular assessment’ of its enterprise and the markets in November 2022 – earlier than the collapse of the $2 billion funding deal and the next restructuring program.

“We’ve been pondering for years about methods to adapt to the setting,” Wingefors says. “However clearly what occurred in 2023 was the scenario for the business, ourselves, and the capital market worsened, and we would have liked to restructure and to make some vital modifications, together with divestments for Saber and Gearbox.

“The monetary market would not just like the volatility of AAA video games. I do not assume AAA video games corporations ought to carry a whole lot of debt, if any”

“Now popping out from this, it was essential to me to go, ‘okay, let’s look into the long run. Let’s create the optimum setting to create success for my folks and the companies, and begin speaking to stakeholders –buyers, workers, business – about how we see the long run.”

The Embracer restructure has been underneath scrutiny ever because it was introduced, with loads of business analysts and commentators – together with our personal Rob Fahey – providing their ideas on how the corporate’s six-year spending spree on studio acquisitions led to this state of affairs.

When requested for his personal perspective on what led to the group’s woes, Wingefors repeats the exterior elements he talked about earlier: the COVID growth, the elevated availability of funding for M&A, the extra steady geopolitical scenario and so on.

“It is a modified gaming market, a modified urge for food from customers,” he says. “The success of the video games we launched decreased prior to now few years as a result of the urge for food from customers or the standard from some titles was not adequate. We would have liked to focus extra and ensure that the investments we’re making finally have a return.

“On the finish of the day, irrespective of the monetary market, the merchandise we create want to seek out the patron and they must be prepared to pay for it – and they’ve a whole lot of totally different decisions. It is a combination of that and clearly the price of capital, which has develop into far more costly – and the urge for food from buyers to place new development capital fully vanished at, I’d say, the top of 2022.

“The truth that we additionally determined to take on debt for the primary time in our historical past, which is one thing in hindsight you could possibly be very humble about. Debt at all times must be repaid.”

Embracer ended 2023 with a debt of $1.5 billion. The sale of Saber Interactive wiped off $205 million, whereas the sale of Gearbox may have worn out extra, however the remaining debt is nonetheless in extra of €900 million / $963 million.

Alongside the announcement of the cut up, there was a carefully-worded press launch relating to a monetary settlement via Asmodee with 5 main banks to the tune of €900 million, and Wingefors spells this out for us: this is the quantity of debt that may transfer from Embracer to Asmodee. It was the acquisition of Asmodee that put the group into debt within the first place, however Wingefors additionally suggests the tabletop writer has the strongest probability of clearing it.

“The banks love Asmodee, they know the corporate has been extremely leveraged on their personal fairness possession for greater than a decade,” he says. “That quantity is principally paying down the debt – not all, however a lot of the debt – within the remaining Embracer Group, that means Espresso Stain & Pals and Center-Earth & Pals. Principally, we’re in a a lot better place from a steadiness sheet perspective at this time.

He continues: “The monetary market would not just like the volatility of AAA video games. I do not assume AAA video games corporations ought to carry a whole lot of debt, if any. You may argue that with cell and recurring revenues, a gaming enterprise might carry some debt, however the capital market would not like to offer that debt. So I believe you must have a really low, if any, debt inside digital gaming over time.

“We’ve taken a whole lot of monetary danger out from Embracer and improved our steadiness sheet and stability”

“I am a agency believer in fairness. I believe debt generally is fairly harmful as a software. You ought to be cautious to hold an excessive amount of in gaming. Board gaming is totally different, it is a very steady enterprise with very steady money flows… We’ve taken a whole lot of monetary danger out from Embracer and improved our steadiness sheet and stability by doing this.”

As for the debt cut up throughout the opposite two corporations, Wingefors says the rest they should repay is “not rather a lot,” particularly as soon as the issues from the Saber and Gearbox divestments clear later this yr.

The CEO additionally clarifies one thing else for us: the Embracer title is going away. As a part of Monday’s announcement, Wingefors additionally said he intends to arrange a brand new holding firm that may assist him type an “possession construction that might be a long-term supporting shareholder,” enabling him to retain possession and be a majority shareholder for all three corporations. The title of this new firm has not been disclosed but, however he stated he is leaving the Embracer title behind.

We ask if this is to distance his next agency from the controversy and backlash round Embracer, particularly over the previous yr, to which he responds: “Under no circumstances. These title modifications are strategic selections geared toward permitting every new entity to develop its personal distinctive model identification, tailor-made to its particular enterprise focus and to maximise its potential out there.”

In the intervening time, Wingefors stays CEO of Embracer Group, which can live on for no less than a yr till Espresso Stain & Pals breaks away in 2025. The main points of the construction of his new holding firm and the way it will work together with the management with every of the three entities might be made clear in time, however for now it feels like this might be much like the decentralised strategy Embracer Group at all times took – albeit with a trio of corporations moderately than a dozen working teams.

Yesterday, we printed Wingefors’ response to the criticism he has acquired relating to his administration of the group and a restructure that led to 3 studio closures and greater than 1,400 layoffs. When requested how he plans to do issues otherwise going ahead, he emphasised that a lot of the decision-making will fall to the chiefs of every entity – Thomas Koegler for Asmodee, Anton Westbergh for Espresso Stain, and Phil Rogers for Center-Earth – in addition to the management groups they construct round themselves (e.g. the CEOs of Plaion, THQ Nordic and different corporations which were cut up between the three teams).

“I would love the administration groups of these companies to type their very own particular technique when it comes to how they function their enterprise, how they consolidate what video games they make, how they monetize, and so on,” he stated.

“Being public is additionally rather a lot about communication, to speak to stakeholders about what’s going on and how the long run seems and so on,” he says, referring to the very fact all three companies may have their very own itemizing on Nasdaq Stockholm. “After we began again in 2016, there have been three folks within the headquarters and it has been a journey to speak the build-up of THQ Nordic first and then later Embracer Group, and at this time it is an infinite job and our quarterly report is very lengthy and full of data.

” The general public markets are very cynical, they solely consider in execution. Do not discuss an excessive amount of, simply ship and it would type itself out”

“The extra you disclose and inform, the extra questions there are. So the administration groups must be conscious about how they impart and why they’re speaking. In the end, I need them to speak first to avid gamers, and I do not assume the general public firm setting is the precise discussion board essentially to speak to customers and avid gamers – and even to workers, despite the fact that we’ve used it to have a standard platform to speak what’s going on throughout the group.

“The belief and worth you’re creating as a public firm is solely pushed by the execution. The best way to speak is to execute, that means make nice video games, earn cash, and take the next step. The general public markets are very cynical and my studying is they solely consider in execution. So what I’ll say to the brand new administration groups is do not discuss an excessive amount of, simply ship and it would type itself out.”

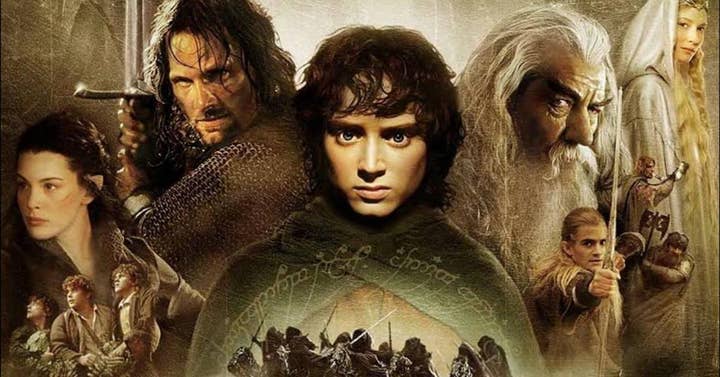

Whereas it is sensible for tabletop writer Asmodee to be separated from the video video games corporations, it is attention-grabbing to see how the remaining have been cut up between Espresso Stain and Center-earth. The previous encompasses all the pieces from indie to AA, in addition to free-to-play, however sees THQ Nordic (the progenitor of Embracer Group) fall underneath Espresso Stain. The latter is positioned because the AAA video games enterprise, however is fronted by Center-earth, a model greatest recognized for its literary and cinematic output than video video games.

Wingefors tells us how the businesses have been divided was based mostly on numerous elements, together with the cultural match of which groups have labored properly collectively prior to now, in addition to the dimensions of the initiatives – “Doing a recreation within the single A or AA area is very totally different from doing an infinite Kingdom Come: Deliverance 2 with 250 folks,” he observes. “Creating the AAA video games or the large video games of tomorrow requires a special administration construction and toolset than is required inside Espresso Stain.”

Within the case of Espresso Stain, he asserts that the indie writer has an analogous monetary profile to Embracer’s cell companies. “They’re very steady, they’re rising, they’ve robust money flows, excessive margins. If you happen to mix them, from a monetary metric it makes a whole lot of sense,” he explains.

He additionally assures that Embracer’s retro video games archive stays a precedence, though it is unclear at this stage the place it would fall throughout the authorized construction of the three entities that emerge from the group’s breakup.

“We [can’t] do all of the sequels avid gamers need for all our IPs and the IP we management or personal – it is inconceivable”

the way forward for Embracer Group and the three corporations that may emerge from it, he says there is “a whole lot of energy to be unleashed inside all three teams” – particularly inside gaming – and talks up the alternatives for transmedia ventures throughout the 900 IPs unfold throughout the three corporations.

“Simply the Center-earth alternative on its personal is simply wonderful if you concentrate on it – what you are able to do and how one can develop that world and how you are able to do that with gaming, but additionally how one can mix it with different media. I am an enormous believer in transmedia. I am inspired to see the success of Fallout on Amazon Prime in current weeks. It is a implausible instance of how you could possibly do a profitable transmedia.”

As has at all times been the case with Embracer, he emphasises that possession of an IP doesn’t imply the businesses have particular plans for them. As a substitute, he believes Espresso Stain and Center-earth might be cautious about what they produce within the coming years – doubtlessly leaving TimeSplitters followers, for instance, in limbo as soon as extra.

“You’ll want to be adaptive,” Wingefors explains. “That does not imply that we might write any cheque [being] blind to anybody. That does not imply that we will do all of the sequels avid gamers need for all our IPs and the IP we management or personal – it is inconceivable. The corporate, or finally the proprietor, that is not adaptive to the setting will develop into out of date.”

Wingefors is additionally fast to reiterate what he has already informed buyers: it is too early to speak about additional M&A offers. As with Embracer, any acquisitions might be dealt with by every firm, with Wingefors predicting that Asmodee is the one one more likely to purchase every other companies, no less than to start with, as and when this technique resumes.

“The main target proper now is to execute, make the video games, consolidate, and get the belief again within the capital markets,” he says.